The techlash against Amazon, Facebook and Google—and what they can do

I imagine your concern about the simmering tech backlash has grown since we ran into each other in the desert in September. The heat directed at your firms has certainly risen. Attached to this e-mail you will find the full report I promised, analysing the grave political and business risks that your firms face. I hope you will read everything I am sending in full, and please do not distribute my work to your underlings, as none of us want this e-mail to leak to the press.

The takeaway is that it is looking more likely that one of you could end up like the giant structure at Burning Man which the crowd torches, watching with rapt attention as it burns down to ash.

See Also: Facebook FINALLY Starts Banning Apps For Abusing Our Data

Things have been rough in Europe for a while. They are getting worse. Having levelled a fine of $2.7bn against Google in 2017, the European Commission’s Magrethe Vestager wants to go further. National governments are also baring their teeth. In December Germany’s cartel office accused Facebook of unfairly using its position to track internet users. France has threatened to fine Facebook for sharing data between its various apps. Almost every day you get hammered for not properly policing the content, including extremists’ videos, revenge porn and fake news, that appears on your platforms.

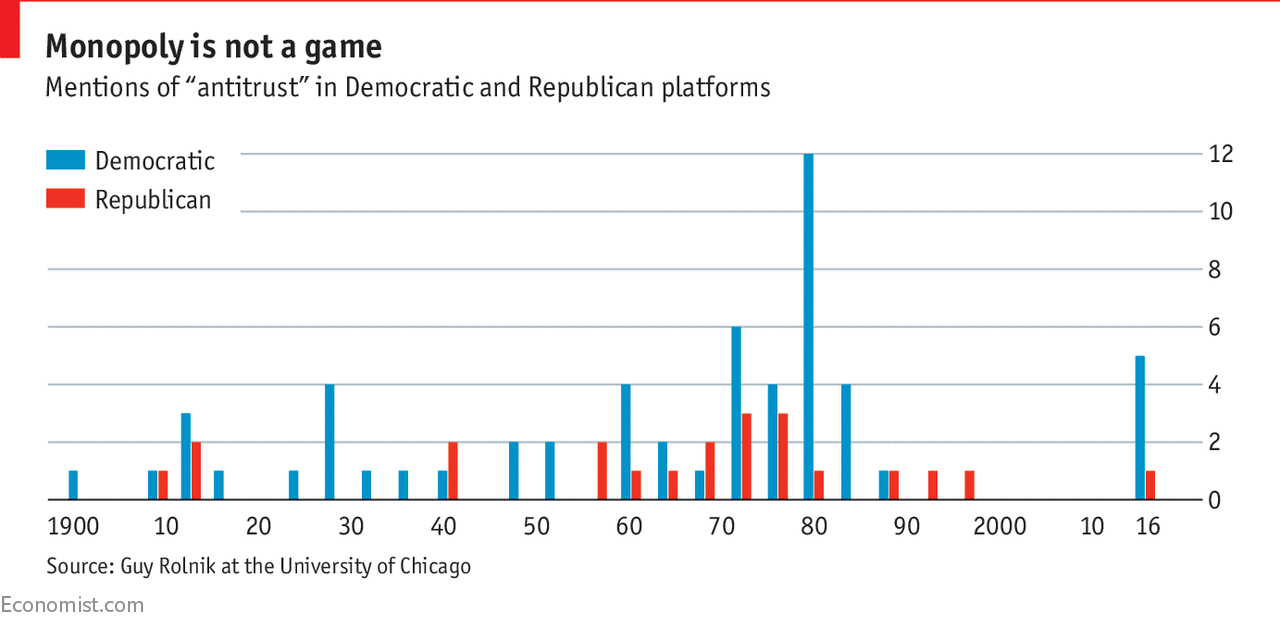

America is not the haven it was. Under Barack Obama tech was treated as a dazzling national asset; he had your back. The candidates in 2020, whoever they are, are likely to run on an anti-tech platform of some sort. Democrats have already pledged to “crack down on corporate monopolies”. The Republicans—besides hating you for being coastal liberals desperate to promote your politically correct worldview—have some business worries, too. Just look at how the Department of Justice (DOJ) is trying to block AT&T’s acquisition of Time Warner, a content company. I know they gutted net neutrality: but that had more to do with hating everything Obama did than valuing a light touch with the internet.

Meanwhile a handful of state attorneys general, including Missouri’s, have launched probes into Google. Any of these could spark a fire. The federal antitrust case against Microsoft started after states investigated the company’s conduct; Texas played a pivotal role in handicapping Standard Oil in the 1880s. The Sherman Act of 1890 followed and by 1911—before the Clayton Act was even passed—John D. Rockefeller’s pride and joy, the greatest company of its day, was lying on the floor in 34 parts. Knowing that a consultant in Washington refers to Amazon, Facebook and Google as “Standard Commerce, Standard Social and Standard Data” should make you shudder.

Rockefeller was once the richest man in the world. Don’t think that crown will help whichever of you is wearing it when the music stops. The fact that four of the five most valuable publicly traded firms in the world are technology companies, with a combined market value of $3trn, gives you muscle. So do the massive revenues which most of you turn into profits. But the fact that all the figures associated with your industry are huge—except for your tax bills—is one reason you have so many enemies.

See Also: Human-Sounding Google Assistant Sparks Ethics Questions

There is one ray of light. Almost all your services remain wildly popular with consumers; they use your products to communicate, to navigate, to search for stuff, to buy things and to socialise. They cannot imagine life without you. This is one reason investors have dismissed anti-tech rhetoric as political grandstanding. But today’s market sentiment could change quickly. An analyst at RBC Capital, Mark Mahaney, recently published a list of “top ten internet surprises for 2018”. “Material regulatory action” against tech was number one; he rated the probability as low but “higher than financial markets ascribe”. And the impact could be huge.

“Tech” is not yet a four-letter word, but it could soon become one.

BAADD to worse

You are an industry that embraces acronyms, so let me explain the situation with a new one: “BAADD”. You are thought to be too big, anti-competitive, addictive and destructive to democracy.

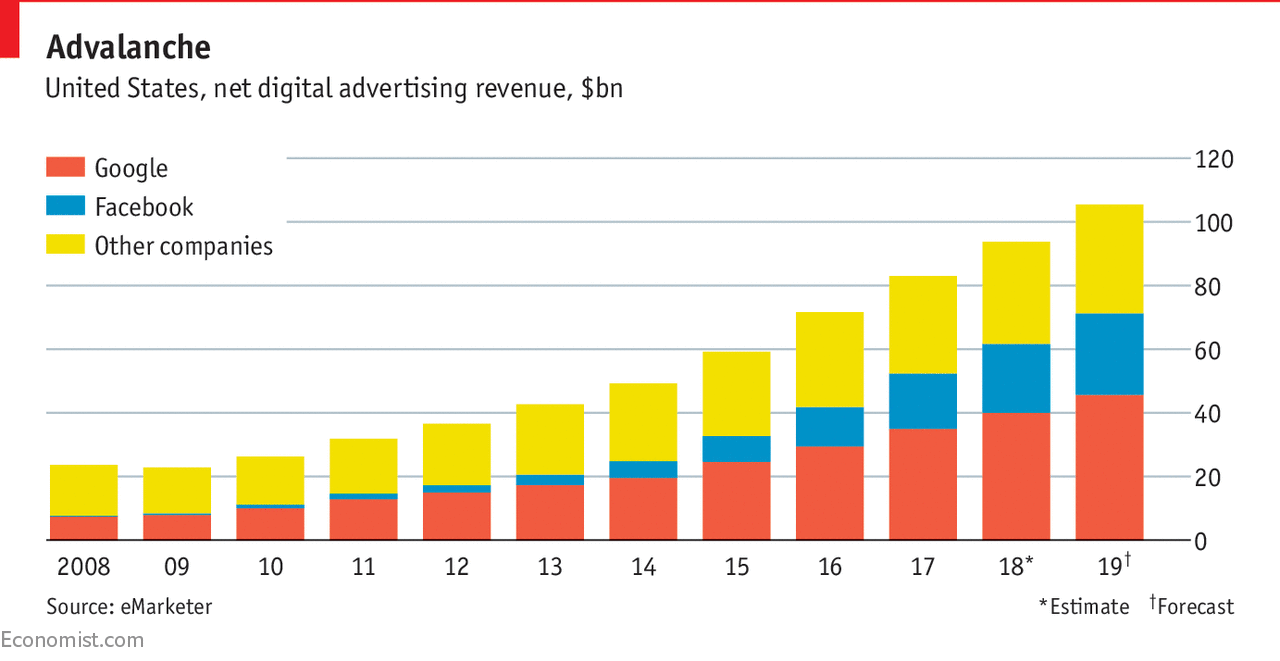

Those who dislike you for being big draw on research from The Economist, think-tanks and academia pointing to the rising concentration in American business, some of which links high corporate profits to inequality. The value of your mountains of data is becoming obvious, especially as you continue to push into new areas that collect more information about consumers while binding them closer to you, such as the home microphones you are careful to call home speakers. Facebook and Google are responsible for nearly 80% of news publishers’ referral traffic. In 2017 they claimed around 80% of every new online-ad dollar in America. Google dominates as much as 85% of online-search-ad revenue worldwide. When you combine the stuff Amazon sells itself with the stuff others sell using it as a marketplace, the company controls some 40% of America’s online commerce.

Many also believe you to be anti-competitive. Amazon is a retailer which is also a marketplace. Google determines the position that publishers get in search results and which ads are served to their patrons—as well as controlling the system that says if the ads were read and should be paid for. Ms Vestager fined it for hurting rival online-shopping services; it could face further charges for forcing smartphone makers using its Android operating system to include various Google apps.

All three of your firms have used insights from the data you gather to spot incipient rivals and buy them up. Facebook’s little-known app Onavo, which tracks users’ smartphone activity, helped it spot several potential threats, including Instagram, a photo app, which it bought in 2012; WhatsApp, a messaging service, for which it paid a stunning $22bn in 2014; and tbh, a social-polling app, which it acquired last year. When Snapchat rebuffed it in 2013, it responded by cloning the app’s most successful features. There’s a potential lesson from history here. Microsoft tried to buy the nascent browser company Netscape in the 1990s; when it failed, it put lots of the browser’s features into its own product, making it freely available to all. That got it into a lot of trouble. Some see the weak share price of Snap, Snapchat’s parent company, as proof that challenging Google’s and Facebook’s online-ad duopoly has become nearly impossible.

A further charge is that tech firms’ products are addictive. People argue about this, but many feel that people who spend time on social media, especially teens, are less happy than peers. Rates of teen depression and suicide have risen in some places; some adults have been shown to be more prone to insomnia, depression and anxiety due to online activities. Two of Apple’s shareholders—the California State Teachers’ Retirement System pension fund and Jana Partners, a hedge fund—recently demanded more be done to help youngsters’ smartphone addiction. You know you are in trouble if a Wall Street firm is lecturing you about morality.

In addition to harming mental health, your firms are charged with damaging democracy. Social-media firms create filter bubbles, where users are fed information confirming their existing beliefs; they spread fake news that reinforces political polarisation. After last year’s terror attacks in London, Theresa May and others pointed fingers at YouTube, where jihadists promote extremist propaganda. Russia’s use of social media in America’s 2016 presidential race reflected particularly poorly on Facebook, which was seen as doing too little to stamp out deceptive ads and fake news stories. As for nuclear braggadocio on Twitter, let’s not even go there.

Proposed actions

Was it Sun Tzu who said: “Your most unhappy customers are your greatest source of learning”? Actually, no. It was Bill Gates. Less good on an ancient Chinese battlefield: wiser, through bitter experience, in the ways of antitrust. These days your unhappiest customers don’t just moan; they go online to discuss innovative regulatory schemes, some of them quite wacky: Joshua Wright, a professor at George Mason University, calls this “hipster antitrust”. Hipsterish or not, here are some of the ideas making the rounds, with the most damaging first:

Break up

This has several supporters, especially on the left. One is Barry Lynn of the Open Markets Institute (he was dismissed from the New America Foundation last year, allegedly because Google’s Eric Schmidt disagreed with his take on tech). Tim Wu, who was influential in the Obama White House—he coined the term “net neutrality”—was recently overheard telling an Economist journalist that he is in favour of a revival of “the big case tradition” of trustbusting. The DOJ or the European Commission could try and force Facebook to get rid of Instagram and WhatsApp (the deal European regulators really care about), thus creating three rival social networks. Google could be split from YouTube (which, kind of remarkably, is itself the world’s second-largest search engine) or be forced to spin off DoubleClick, the technology it bought in 2007 that places ads across the web.

Such gambits might well fail; but that risk is not the deterrent you might expect. Mr Wu and others think such attempts serve a greater good even if their subject survives. Before eventually breaking up AT&T, which controlled America’s telephones, regulators forced it to license its technology. Neither IBM in the 1960s nor Microsoft in the 1990s was actually split up. But IBM had to open its platform to independent software developers and Microsoft was obliged to disclose details about the workings of its Windows operating system to rivals. Some scholars reckon this government-ordained disruption was as much of a boost to progress as any endogenous “creative destruction”. They may not be going too far when they trace the rise of your generation of tech firms to those antitrust cases.

Pre-emptive action might sometimes be an option. Some see your search for a second headquarters, Jeff, as a portent of such a strategy: a step towards spinning off Amazon Web Services. (This would not allay concerns about Amazon being both a retailer and marketplace, but it could subdue and distract regulators.) The creation of Alphabet as a holding company in 2015 means that splitting, say, Google from YouTube would be less hard than in years gone by.

Self-severance might be preferable to waiting for regulators to arbitrarily decide which limb to sever. But it is still a big step. An alternative is just lying low. Do not provoke regulators, as Mr Gates did (he called one FTC commissioner a communist). Do spend some of your money on influence. In 2017 the internet sector spent $50m on lobbying in America, which is three times what it spent in 2009—but still only a quarter of what pharma firms spend. Your K-street battalions should remind regulators that attacking deals which have already been done chills the market. And the antitrust hipsters need to know that break-ups are not stable solutions. The network effects that make bigger networks more attractive to new joiners give these markets a winner-takes-all quality. One of the Googlettes, or the Facebabies, will do better than all the rest, and a new giant will rise.

Utility regulation

That said, taking this winner-takes-all argument too far could backfire. Mark, you and your peers may all come to rue the day you described Facebook as a “utility”. You were trying to argue that Facebook’s market-dominating social network could be as ubiquitous as electricity. In doing so you armed your critics. Utilities so big that everyone depends on them get regulated.

That could be really disastrous. Have a look at “Railroaded” by Richard White, a historian at Stanford. The Interstate Commerce Commission (ICC) was created in 1886 to stop train companies discriminating against particular farmers by establishing set and transparent pricing. It quickly overreached and ended up regulating trucking and the telegraph. It also proved chronically prone to regulatory capture—which, I admit, might be an upside for you, but which in the case of the ICC was a disaster.

Price regulation is hard for services that are basically free to the user. It is possible, though, that a regulator could force prices up—for example by insisting that you offer customers the chance to pay for an ad-free service. A more likely approach, though, would be to cap profits. On the basis of your third-quarter figures, a mandated 20% rate of return would represent a fall in profitability rates of 11% for Google and 56% for Facebook. Your share prices would plunge.

Prevent new acquisitions

In 1968 America’s merger guidelines suggested that any acquisition of a company with a market share of more than 3% by one with a share higher than 15% should be challenged by the DOJ. There are no limits like that any more. For the past four decades American antitrust thinking has been in thrall to the argument which Robert Bork, a legal scholar, made in “The Antitrust Paradox”: consumer welfare is the thing antitrust should worry about most. In practice, this has boiled down to thinking that if prices don’t go up no harm is done. Around the same time economists of the Chicago School, devoted to the idea that markets are self-correcting, started to have a big influence on antitrust enforcement under President Ronald Reagan—or, rather, lack of enforcement.

It is a sign of the times that the University of Chicago is today home to several professors, such as Luigi Zingales and Guy Rolnik, calling loudly for more scrutiny of tech firms. Many believe that looking simply at prices and market shares is too simplistic—especially when technology is often free to the user and constantly changing the shape of the market. One reason that Britain’s Office of Fair Trading was relaxed about Facebook’s Instagram purchase was that it saw Instagram as a “camera and photo-editing app”, not a social network, and thus unlikely to ever be “attractive to advertisers on a stand-alone basis”. Clearly they lacked imagination.

Europe has always used a range of metrics, taking on board market concentration and consumer welfare—which includes price, quality and the diversity of products in the market—to evaluate fair competition. And countries there clearly now want to police more deals. Last year Germany and Austria changed their merger-review policies to assess deals based on the values, not revenues, of the acquired firms. This will enable them to scrutinise the acquisition of startups that do not yet make money. Ms Vestager has suggested this could apply across Europe. Some would like to see it applied in America.

Amy Klobuchar, a Democratic senator, has proposed two bills to change the standard for big deals, requiring firms to prove that their deal would be helpful to competition and to report data about a merger’s impact for five years. Those bills won’t pass, but a “potential competition doctrine”which looks at what the small fry might become, not at what they are today, could emerge through new precedents. It is also possible that bodies of user data, as well as market shares, might get considered.

My advice? Don’t pursue any big deals in this current climate. Microsoft misjudged the mood by trying to buy Intuit, a maker of financial software, for $1.5bn in 1994; the episode drew attention to other aspects of its market power. And, frankly, small deals may be out, too. Facebook’s acquisition of tbh is for a paltry $80m, but it has still sparked cries of foul from tech watchers such as Ben Thompson at Stratechery, a newsletter, who think that network effects mean no social networks should be allowed to merge. For the time being, your shopping trolleys should be kept empty.

Data portability and interoperability

There are two overlapping issues about customer data. One is that data bind users to you; the other is that data give you an anti-competitive edge. Remedies to the first problem seek to let customers move their data elsewhere; remedies to the second seek to force you to share their data with others.

Google already voluntarily offers a “takeout service” which lets users export a copy of their data. Europe’s General Data Protection Regulation, which comes into effect this May, will extend the principle of data portability to other platforms. Observers compare it to how mobile-phone users can switch networks without losing their phone number. This should not worry you too much. Most customers won’t care; very few people are up for the hassle of actually using Google’s takeout service. And your dominance means there is very little funding for new search engines and social networks, and thus few alternative services to which consumers can port their data.

But that dominance has a downside. It is the reason why some people want to force firms to offer “API keys” which give competitors access to particular data, such as Amazon’s sales figures or the “social graph” of Facebook’s users’ connections. You will probably want to fight sharing data in such ways, because the critics have a point: newcomers are hard put to compete. The days when Instagram was able to grow by using an API that allowed people to discover all the people they followed on Twitter as soon as they joined are long gone. You may find that you have surprising allies in the fight, too. Some privacy advocates find the idea of data being forcibly shared pretty worrying.

Losing that fight could be uncomfortable, but it would hardly be deadly. Indeed, while it would hit your share price, it could offer long-term advantages. The way in which it opens you up to competition reinforces your centrality to the ecosystem—and that ecosystem may, as a result, grow faster. The interoperability forced on Microsoft at the turn of the century, which allowed rivals to make their products more compatible with Windows, had that sort of accelerating effect—and Microsoft has hardly gone away. It is worth more than three times as much now as it was then.

A new dispute-resolution group

Techlashers think one reason regulators have come up short is that they are overburdened policing too many industries. New groups to handle complaints and resolve disputes could make things faster and simpler. If a retailer feels it has been unfairly squashed in Amazon’s search results, or a newspaper believes its ranking in Facebook’s feeds is too low, they could go to such outfits for redress.

There are two potential models. Firms could start their own “technical committees” made up of external experts with access to the relevant proprietary code, data and algorithms. They would be empowered to decide whether other firms are being fairly treated. Again, that is what happened in the Microsoft case. The alternative would be an independent external tribunal. America has panels for disputes about patents and about discrimination by cable-TV operators which might serve as precedents.

You may not like the idea of creating a new tribunal (or the very word “tribunal”), but it is in your interest to see complaints resolved easily and cost-effectively. In the meantime, start being more careful about how you treat rival firms. It might have been different before, but anti-competitive behaviour is suddenly being taken very seriously. Like sexual harassment accusations, it carries a reputational cost. “M”, for monopolist, is today’s scarlet letter.

Content liability

The laws and precedents that free you from liability for the content that you host have been a boon; but they were not set up for a world in which your platforms have become essential media properties in their own right. Your blanket protection is not going to last.

Though some of you have tasked your lobbyists with trying to weaken it, sensing the thin end of a wedge, an American bill that would hold you liable for online sex-trafficking is likely to pass. Germany can now impose fat fines if flagged content is not taken down within 24 hours. Laws of this nature are probably not the catastrophes you have denounced them to be. You will have to hire more “moderators”, but in time you will develop new technologies to screen out undesirable content, as you already do with spam. Google’s ability to deal with “right to be forgotten” claims, which enable people to request information about them to be taken down, has become a well-oiled machine, far from the tremendous burden some had feared.

The way ahead

In general, when you can get out ahead of the issue you should do so. Embracing transparency about who pays for political ads before Congress got around to requiring it of you was a smart move. Look at setting up your own technical committees, too.

Your new-year’s pledge to “fix Facebook”, Mark, looks like a bold effort in this direction. Have a care, though: some people may want more fixing than you are happy to offer. There are some who say you can never deliver what is needed without scrapping your ad-based business model, which will always value engagement over the quality of the experience. And when fixes like changing the newsfeed algorithms have effects on lots of other companies, you may both harm your business and reinforce concerns about its immense power.

It is critical that you compete with each other. If you are waging war on various fronts, such as commerce and digital advertising, you look a lot less monopolistic. This is probably an argument for keeping alive businesses that you might otherwise scale back, as Google has done with its social offering, Google+. Acting as if your rivals are too well-resourced and entrenched for even another giant to take on lends credence to the arguments against you.

And there’s another lesson from the robber barons—one that some of you and your peers have already embraced. Philanthropy can change people’s opinions and shape your legacies into the far future. In part because you do not employ as many people as corporate giants of previous eras, it is critical to think about local initiatives that can woo public opinion around the world. Mark has made the biggest strides in setting up a foundation. The rest of you could form personal or corporate foundations, too.

If you have any questions, please be in touch by an encrypted app.

Very sincerely yours,

Eve Smith

Invisible Hand Strategies, LLC

Originally Published in The Economist.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.